With many new homeowners looking at making a saving with the stamp duty holiday, the time has never been better to look at home improvements.

In 2020 the government announced that they are going to introduce a stamp duty holiday. That means that any house bought up to £500,000 will not pay stamp duty*. Therefore, if you have recently bought a property, you may be wondering what to do with the stamp duty money you saved.

That is why we have put together a list of home improvement projects that could be an excellent choice for a new homeowner. Plus, we will take a look at how much stamp duty you could save on your home.

*That does not include commercial, buy to rent or second properties. Welsh, Scottish and Northern Irish properties may have different rates and taxes.

What Is Stamp Duty?

Stamp duty is a tax that most house buyers will need to pay. Furthermore, it is usually a percentage of the total cost of the property. However, due to the Coronavirus pandemic, the British government chose to reduce the stamp duty to help people looking for a home.

Stamp Duty Thresholds

Our guide shows you how much you could save through the stamp duty holiday.

Property Price

£0-£500,000

£500,001-£925,000

£925,001-£1,500,000

Above £1,500,000

Stamp Duty

0%

5%

10%

12%

If your house costs £600,000, the first £500,000 will be 0%, then £100,000 will be at 5%.

You can get a more accurate figure by going to the HMRC stamp duty calculator.

What To Do With The Savings

If you are a new homeowner, you may want to save this money in case of an emergency. However, unless you find the perfect home with your design style, you may need to look at improvements to make your house a home.

We have put together a list of home improvements that may improve your new home and make it more comfortable. Plus, with the government predicting that the average stamp duty bill will reduce by £4,500, it may be the perfect time to consider these repairs.

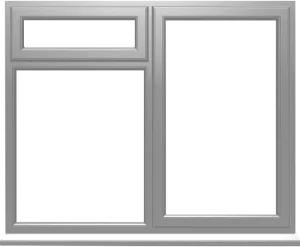

Double Glazing

If the home you are moving into has single glazing, then double glazing or triple glazing is an excellent choice. That is because single glazing is out-dated and is not energy-efficient. Furthermore, uPVC double glazing is one of the best options to keep your home insulated and warm throughout the winter.

Although triple glazing is an excellent insulator, it can be more expensive than double glazing.

Insulation

Insulating your property is an ideal way to help keep the warmth throughout the winter months. There are several insulation options for your home, and one of the most effective is loft insulation. Furthermore, loft insulation is one of the cheapest home improvements that can improve energy-efficiency.

Decorating

Unless the previous owners had your style, you most likely want to decorate. That may include a simple paint job or some stylish curtains. However, you may consider taking advantage of the stamp duty threshold and choosing a larger project.

Try and think about how these home improvements will affect you. Do you spend a lot of time in the kitchen but do not like the cupboards. You may want to take this opportunity to redecorate part of the home where you spend a lot of your time.

Energy-Efficient Doors

Another fantastic choice to add style and practicality to your home is to consider an energy-efficient door. If the entrance to your new home is old and worn, it could cause many problems. Therefore, replacing the door with a uPVC or composite door can help reduce drafts and make your home more energy-efficient.

One of the most stylish choices for your new home is the composite door. They come in a variety of styles and colours and can make your home look fantastic.

Summary

The stamp duty threshold ends on March 31st 2021. However, if you save some money on your home purchase, you could improve your property with the savings.

Consider how these upgrades will affect your quality of living. Double glazing and insulation can reduce energy consumption and save money on your bills. Or, if you love relaxing, you may want to decorate your lounge or bathroom. The choices are endless. Be sure to make the most of your reduced stamp duty thresholds.